cheap full coverage car insurance that actually protects

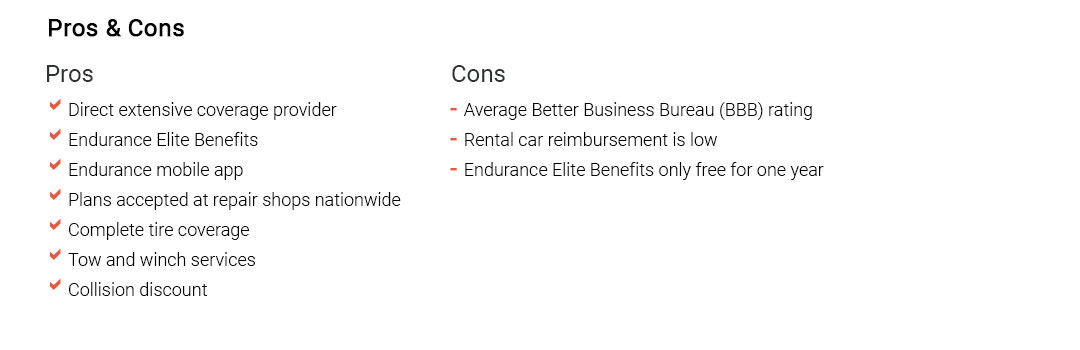

I look at price last. Not because money doesn't matter, but because protection does. "Full coverage" is shorthand - liability plus comp and collision, often extras. Some say the cheapest is always risky; I disagree softly. Cheap can work if the policy is built on support and clear limits, proven in real claims.

What "cheap" should still include

- Liability limits above state minimums.

- Comprehensive and collision with workable deductibles.

- Uninsured/underinsured motorist where exposure is high.

- Medical payments or PIP, even modest.

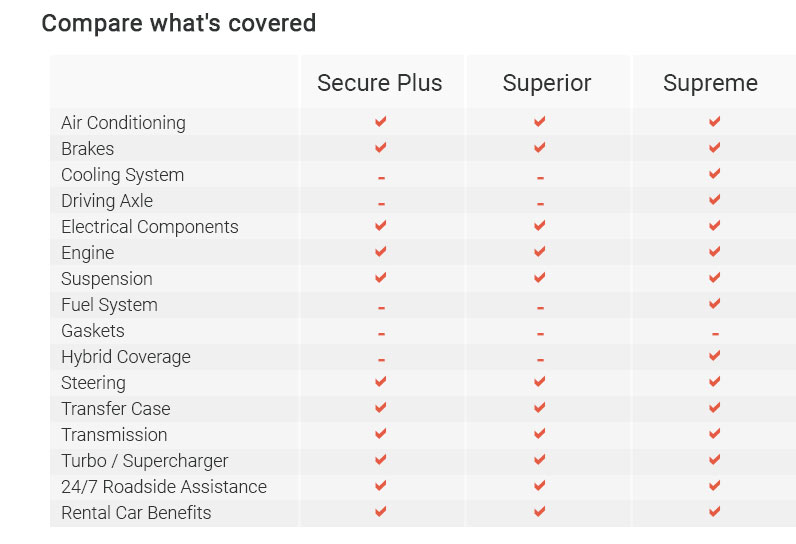

- Rental and roadside for real downtime help.

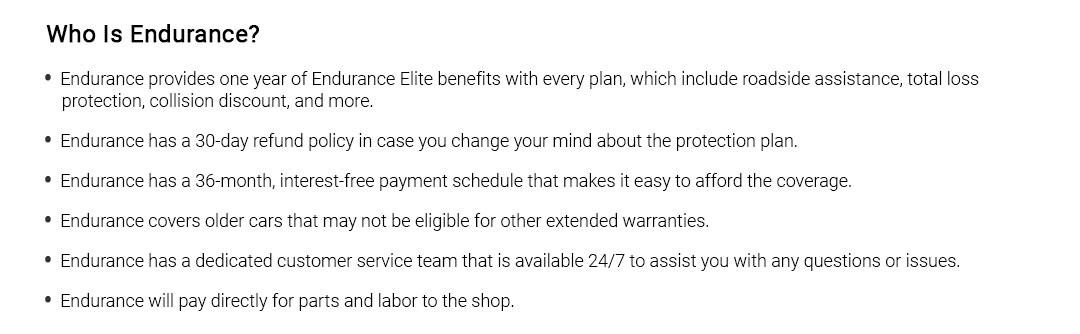

- 24/7 claims and choice of repair shops.

How to evaluate value quickly

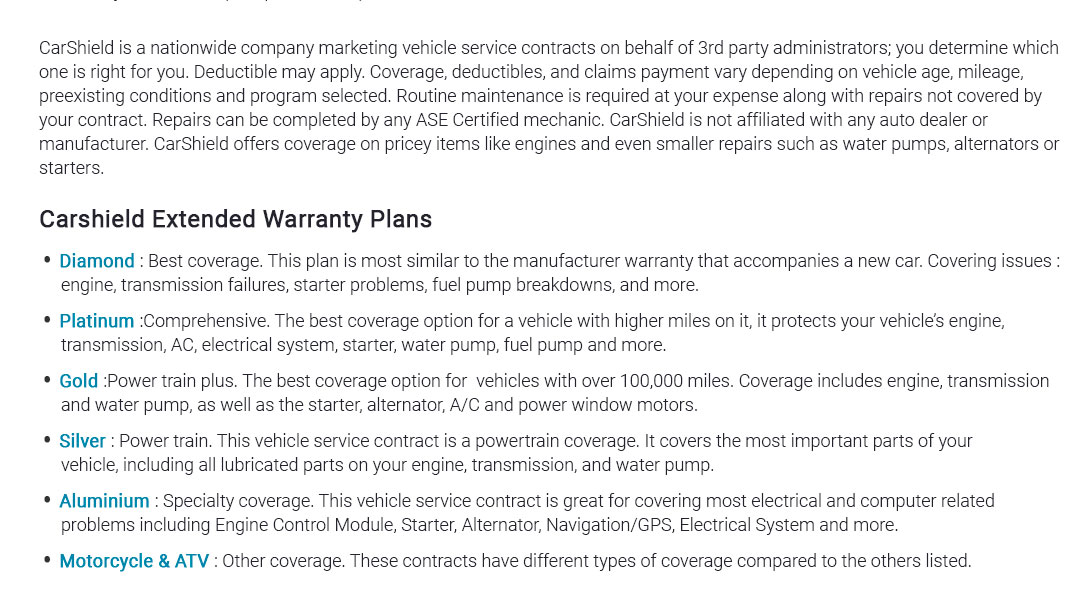

- Quote apples-to-apples and note deductibles.

- Check claim reputation and repair network.

- Add likely costs: a cracked windshield, a tow.

- Stack discounts (bundle, telematics, safe driver).

Last month, a coworker tapped a bumper in rain. Her cheap full coverage paid repairs, covered a rental, and the 24/7 line felt human. That's the metric: outcomes, not slogans.

If you rarely drive, liability plus savings might win. For most daily or financed cars, compare three quotes yearly, keep deductibles aligned with cash on hand, and make support easy to reach.